Rare Wall Street unanimous 2026 call means Nvidia is pressure point

Jan. 2nd, 2026 12:03 amAnalysts on Wall Street almost never agree on anything.

That's why one thing that stands out in late-2025 strategist outlooks is important as we move into 2026: Not one strategist predicts a poor year for the S&P 500 in a large survey of major broker estimates compiled by Bloomberg.

That doesn't mean there will be difficulties right away. But it does provide investors something they don't often get: a clear "base case" to examine.

Rather than viewing the consensus as a warning sign, see it as a blueprint — a list of things the market wants you to embrace if you want to ride the upswing.

CFRA’s strategists, cited by TKer by Sam Ro, offer advice for 2026.

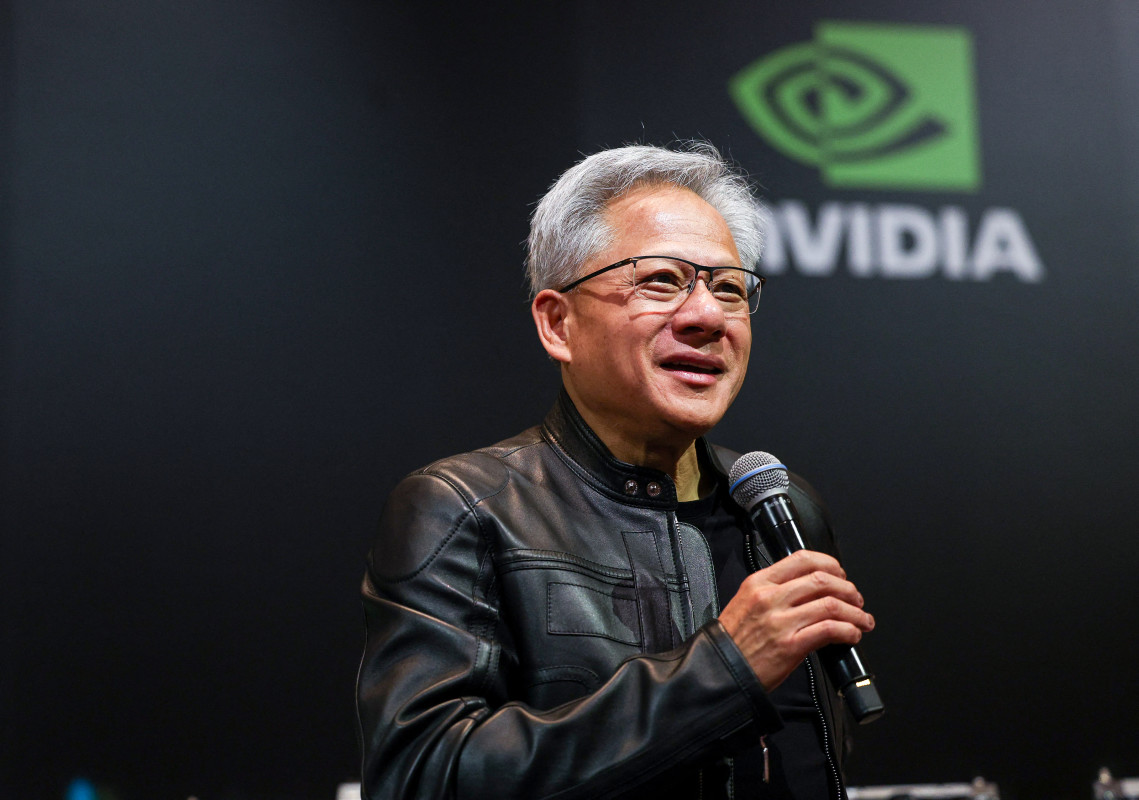

Nvidia is the only company that meets almost all of the assumptions in that bullish outlook, such as earnings growth, AI spending, high valuations, and the market's top-heavy leadership.

The same question keeps coming back, no matter whether 2026 is another good year, a year with many ups and downs, or a year that breaks the run.

Does the AI engine keep going, or does it sputter just enough to send the market into a tailspin?

Analysts' consensus isn’t the trade; it’s the checklist

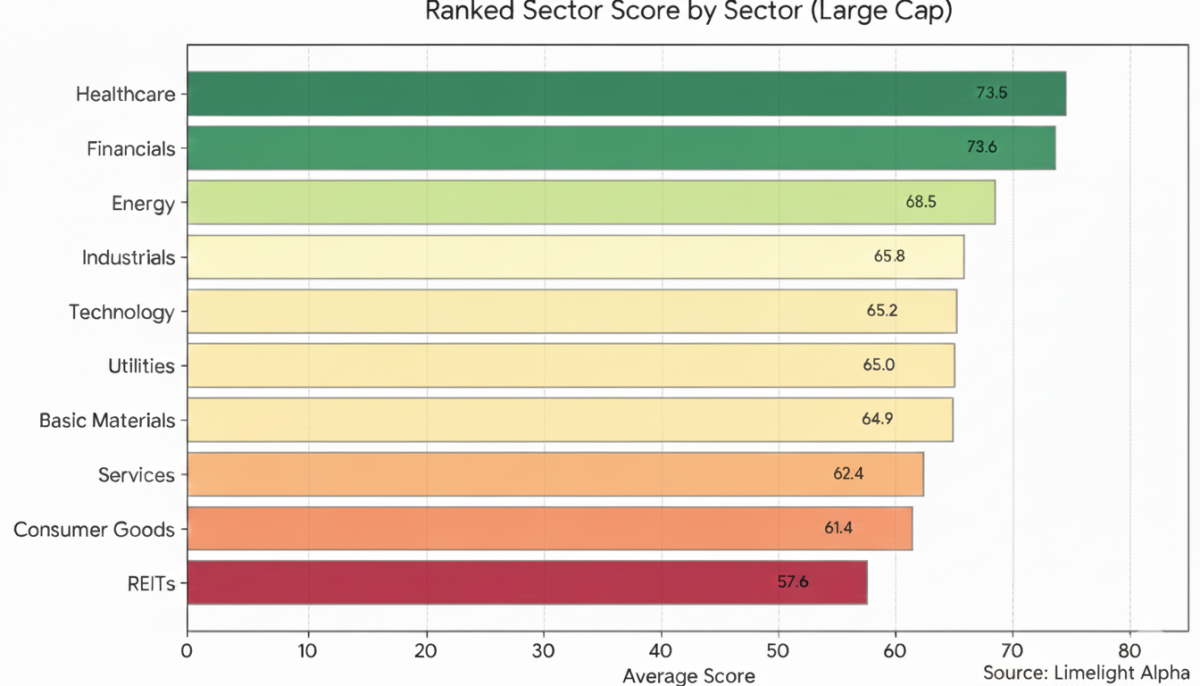

A consensus bullish call usually boils down to a few things on which everyone agrees.

- Earnings will grow fast enough to justify prices.

- Interest rates won't make things worse financially like they may when inflation rises.

- AI expenditure is not only intriguing; it is also strong.

- The market's leaders, who are still mostly big IT companies, won't break.

That's why the consensus is so helpful. It shows investors what they need to stick to.

More Nvidia:

- Nvidia’s China chip problem isn’t what most investors think

- Jim Cramer issues blunt 5-word verdict on Nvidia stock

- This is how Nvidia keeps customers from switching

- Bank of America makes a surprise call on Nvidia-backed stock

Even if one pillar fails, the market can still rise, but the journey may become challenging due to drawdowns that test discipline. If those foundations stay strong, the index might have a mid-to-high single-digit year.

The most important thing is to stop thinking in terms of "all in" or "all out" and start thinking like a risk manager: What am I betting on, and what would show me wrong?

Why Nvidia is the perfect “anchor stock” for 2026

Nvidia isn't simply good at AI. It's a story about the market in one ticker.

- AI capex proxy: Nvidia is usually the company that gets the most money when big corporations buy AI infrastructure.

- Stress test for valuation: Prices go up quickly when expectations are high. That makes the stock (and frequently the whole sector) more sensitive to surprises.

- Check the breadth: If a small group of leaders conducts most of the work, Nvidia's strength can hide weakness in other areas. The disguise falls off quickly if Nvidia fails.

That doesn't imply investors should worry about Nvidia's daily changes. It means that Nvidia is a good way to keep an eye on whether the core engine of consensus optimism is still working.

So here's the plan: four questions investors can ask all year long.

Blueprint Step 1: Track the “AI spend vs. AI hype” gap

When the story stays hot but spending slows down, that's when the late-cycle rallies are most perilous.

Investors can break down the AI question for 2026 into two groups:

- Real demand involves orders, visibility over many quarters, and more deployments.

- Narrative demand refers to significant headlines that suggest growth and customers who are adopting a "wait-and-see" approach, despite actual results that are not improving.

It's not only about Nvidia's revenue growth; it's also about what management says regarding demand, and whether it's pulling forward from the future or developing steadily.

Not every AI business has to do well for the stock market to have a good year. But the AI theme needs to avoid the kind of shock that makes investors doubt whether the spending surge was just a short-term high.

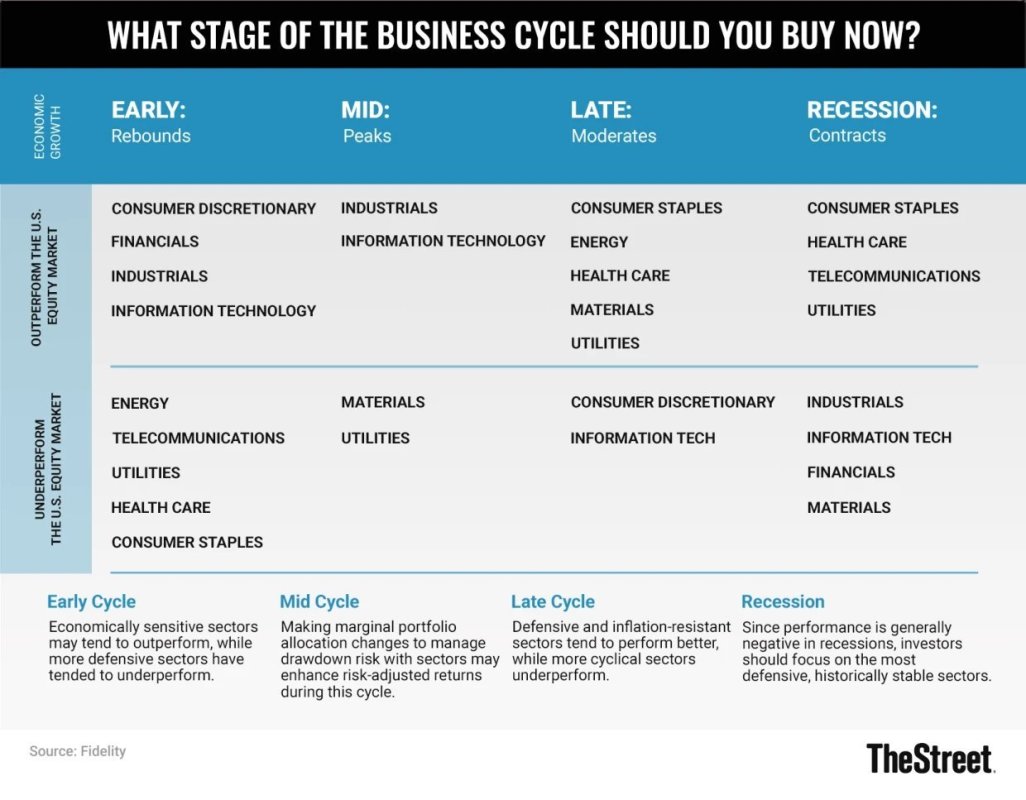

Blueprint Step 2: Assume valuations are a headwind, not a tailwind

When everyone expects gains, the market often isn’t priced for “good.” It’s priced for “great.”

That impacts what investors can expect in 2026:

- More gains will depend on how well results are handled, not how much the stock price goes up.

- Bad news doesn't have to be terrible to hurt. Sometimes "less good than hoped" is enough.

Nvidia is right in the thick of this. Even if a company shows it's the best, the stock might still go down if the market thinks the future isn't as good as it thought it would be.

Blueprint Step 3: Watch market breadth like it’s a smoke alarm

A bull market is healthy when more than one trade is going on at the same time. When a few big companies make most of the returns, the index can look strong, even when many equities are doing poorly.

That's why the uniform bullishness for 2026 needs to be looked at more closely: It can still be an "up year," even if the average investor's portfolio feels a lot worse, especially if they own the same stocks as everyone else.

Nvidia can also help with this.

- It's not "broad strength" if Nvidia is going up, but everything else is flat.

- If Nvidia stays consistent and other parts of the market get involved, that's usually better.

Blueprint Step 4: Plan for volatility, even if you’re bullish

One of the easiest ways to lose money in a year when things are going well is to not realize how terrifying the middle of the year might be.

You should expect some combination of these to happen at some point, even if the market ends 2026 higher:

- A scare from the Fed

- A hiccup in earnings guidance

- A shock in world politics

- An AI mood reset after a bull run

A recession isn't necessary for any of those. All investors need to do is acknowledge that the "perfect" route they priced in isn't certain.

The bottom line on Wall Street's optimistic view of 2026

You shouldn't just follow Wall Street's rare, unified optimistic call for 2026, nor should you instantly fade it.

Use an investment strategy that keeps you from getting too comfortable.

- If your time frame allows it, stay invested.

- Use Nvidia as a real-time test of whether the AI part of the bull thesis is still valid.

- Set your positions so you can handle market swings without making emotional decisions.

- Don't put all your eggs in one basket; spread them out.

If the consensus is right, this blueprint keeps you in the game. If the consensus is wrong, it reduces the odds that you learn that lesson the expensive way.

Related: Warner faces a surprise new bid as investors do the real math

Джим Джармуш, Адам Драйвер и Кейт Бланшетт напоминают о важности семейных уз.

Джим Джармуш, Адам Драйвер и Кейт Бланшетт напоминают о важности семейных уз.